Safeguard Your Home and Loved Ones With Affordable Home Insurance Plans

Value of Affordable Home Insurance Policy

Securing budget friendly home insurance is crucial for protecting one's home and financial health. Home insurance offers security against different threats such as fire, theft, natural disasters, and individual responsibility. By having a detailed insurance coverage strategy in location, property owners can feel confident that their most substantial investment is safeguarded in the occasion of unforeseen conditions.

Economical home insurance not only supplies financial safety however likewise offers peace of mind (San Diego Home Insurance). Despite increasing home worths and building expenses, having an affordable insurance plan ensures that home owners can easily reconstruct or repair their homes without encountering considerable financial concerns

Additionally, budget-friendly home insurance can also cover individual belongings within the home, providing repayment for items damaged or swiped. This protection extends past the physical structure of your house, protecting the components that make a residence a home.

Coverage Options and Limits

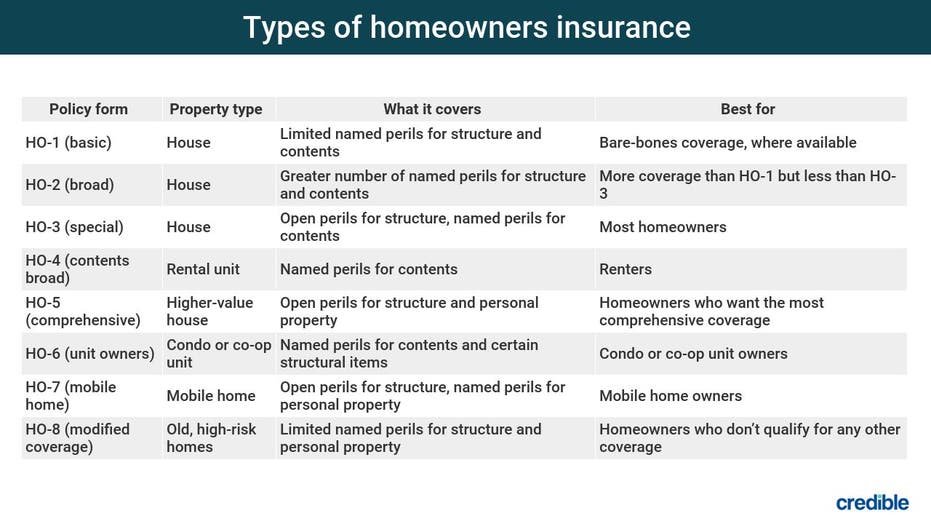

When it concerns insurance coverage restrictions, it's critical to comprehend the maximum amount your policy will certainly pay out for each and every kind of protection. These limits can vary relying on the policy and insurance provider, so it's important to review them meticulously to guarantee you have sufficient defense for your home and possessions. By comprehending the coverage alternatives and limitations of your home insurance policy, you can make enlightened decisions to safeguard your home and loved ones effectively.

Aspects Affecting Insurance Policy Costs

Several variables dramatically affect the costs of home insurance coverage policies. The location of your home plays a critical duty in identifying the insurance coverage premium.

Furthermore, the kind of coverage you choose directly impacts the cost of your insurance plan. Choosing additional insurance coverage choices such as flooding insurance or quake protection will certainly enhance your costs. Similarly, picking greater protection limitations will result in greater expenses. Your insurance deductible quantity can additionally influence your insurance prices. A greater deductible typically indicates lower premiums, however you will have to pay more expense visit this site right here in case of an insurance claim.

Additionally, your credit history, declares history, and the insurance coverage business you choose can all affect the price of your home insurance coverage. By considering these factors, you can make informed choices to assist manage your insurance coverage costs effectively.

Comparing Companies and quotes

In enhancement to comparing quotes, it is critical to assess the reputation and monetary security of the insurance service providers. Look for consumer evaluations, ratings from independent firms, and any background of complaints or regulative actions. A reputable insurance policy supplier need to have a good performance history of without delay processing claims and supplying exceptional client service.

Furthermore, think about the certain insurance coverage attributes offered by each supplier. Some insurance providers may provide fringe benefits such as identification burglary protection, devices malfunction protection, or protection for high-value products. By meticulously comparing companies and quotes, you can make a notified decision and choose the home insurance coverage strategy that finest meets your link requirements.

Tips for Saving Money On Home Insurance

After thoroughly comparing companies and quotes to find one of the most suitable insurance coverage for your requirements and budget plan, it is sensible to check out effective strategies for minimizing home insurance coverage. One of try here one of the most considerable methods to reduce home insurance coverage is by packing your policies. Many insurer use discounts if you buy numerous plans from them, such as integrating your home and automobile insurance coverage. Increasing your home's protection measures can likewise lead to financial savings. Installing safety and security systems, smoke alarm, deadbolts, or a lawn sprinkler system can lower the risk of damages or theft, possibly decreasing your insurance premiums. Furthermore, preserving a good credit report score can positively impact your home insurance coverage prices. Insurance firms typically think about credit report when identifying premiums, so paying bills in a timely manner and handling your debt responsibly can result in reduced insurance policy expenses. Lastly, frequently reviewing and upgrading your plan to show any type of changes in your home or conditions can ensure you are not paying for coverage you no more demand, assisting you save cash on your home insurance policy premiums.

Conclusion

In conclusion, securing your home and enjoyed ones with inexpensive home insurance coverage is critical. Implementing ideas for conserving on home insurance policy can likewise assist you protect the required protection for your home without breaking the financial institution.

By untangling the intricacies of home insurance strategies and discovering functional methods for protecting cost effective insurance coverage, you can ensure that your home and enjoyed ones are well-protected.

Home insurance coverage policies commonly use a number of insurance coverage choices to safeguard your home and personal belongings - San Diego Home Insurance. By recognizing the insurance coverage options and restrictions of your home insurance coverage policy, you can make enlightened decisions to safeguard your home and liked ones successfully

Consistently examining and updating your plan to show any kind of modifications in your home or situations can guarantee you are not paying for coverage you no longer requirement, aiding you save money on your home insurance policy costs.

In verdict, safeguarding your home and liked ones with affordable home insurance coverage is critical.